What Is The Difference Between Whole Life And Term Insurance

What Is The Difference Between Whole Life And Term Insurance. Monthly premiums are extremely lower, closer to the price of a daily coffee. Term life plans are much more affordable than whole life.

Term life insurance is insurance that you can buy to cover a set period of time, or a term. Term life insurance is cheap when compared to whole life. Term life insurance is best for the period of life when the need for financial provision is greatest;

Whole life insurance is much more expensive than term life insurance.

With higher insurance coverage, the term insurance policy secures the financial future of the family especially in the absence of the breadwinner of the family. Term life is “pure” insurance, whereas whole life adds a cash value component that you can tap during your lifetime. Term life insurance is best for the period of life when the need for financial provision is greatest;

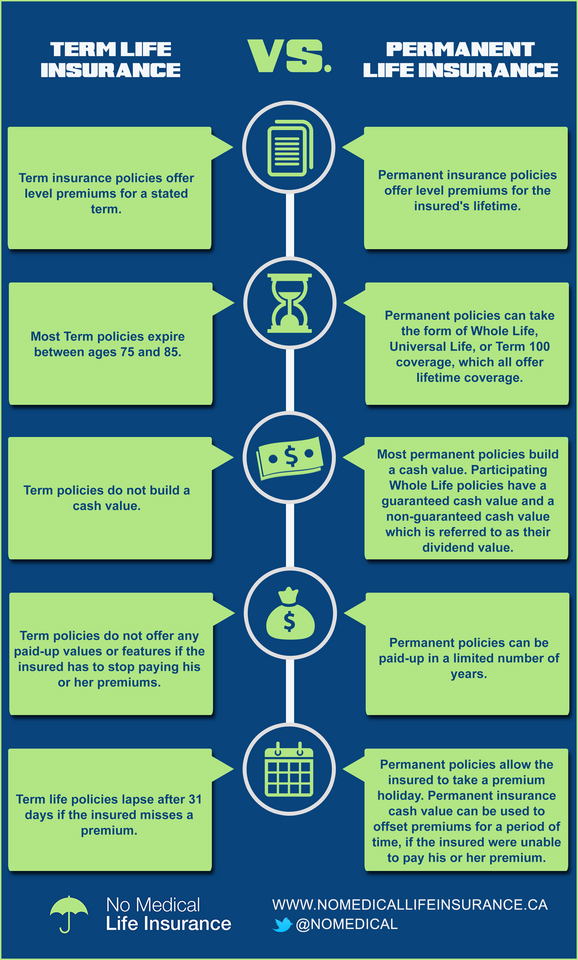

The first difference between whole life and term life insurance is that whole life insurance has a coverage over the entire life of the policy holder while the term life insurance has the coverage over the life but only for a limited duration.

The principal advantage of term life insurance is that it’s substantially simpler and less expensive than whole life insurance. Term life insurance only lasts for a set period of time and are cheaper and easier to obtain; There are different kinds of life insurance, offering flexibility for consumers.

Reflecting its simplicity, term life is often called ‘pure’ life insurance.

Whole life insurance cost comparison. However, over time, whole life insurance is actually the better option. One of the main differences between whole and term life insurance is the cost.

The main difference between whole life and term life is that term life insurance provides temporary coverage for a specific period while whole life provides coverage for your entire life.

Term coverage only protects you for a limited number of years, while whole life provides lifelong protection—if you can keep up with the premium payments. Lasts for a specific term length (usually 5, 10, 15, 20, or 30 years) does not build cash value; Even so, whole life insurance tends to have higher premiums than term life insurance.

It covers you for a set period of time and.

Term life is usually more affordable, while whole life can build a cash value. There are a number of key differences between whole and term life insurance. Term life insurance is insurance that you can buy to cover a set period of time, or a term.

Post a Comment for "What Is The Difference Between Whole Life And Term Insurance"